Purchase Timeline

Published:

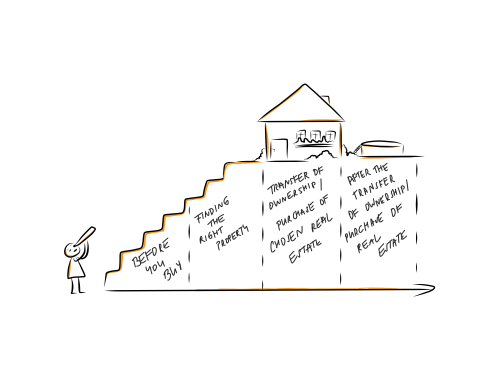

Here we will try to outline and explain the individual phases and steps to go through when buying a property and show them to you on a timeline. Some depend entirely on you, others depend on other people, and some follow each other logically and precisely. This is a process in which a large number of variables can arise, so this article focuses mainly on the basic core stages. If it turns out that you experience circumstances which are not described here, please do not hesitate to contact us with your questions. We will be happy to give you answers to your specific queries.

The basic purchase process can be divided into the following areas:

- Before you buy

- Finding the right property

- Transfer of ownership/purchase of chosen real estate

- After the transfer of ownership/purchase of real estate

These steps were explained in the previous article, “Buying a property - what awaits me”. Here we will look at how these groups are further divided and what needs to be done during each of them.

Before you buy

You could say that this phase should include a decision on what real estate we are actually looking for. It is preferable, but not actually the fundamental question we need to answer at this stage. It is possible to postpone this decision until the second phase, namely finding the right property. It is not unusual that people start off looking for an apartment and end up moving into a house and vice versa. And there’s no harm in that.

So what is required at this stage? Before you start looking for a suitable property, you need to resolve the issue of financing. It is fundamental to everything else, whether or not you have a sufficient amount in your bank account of so-called “cash”. Please note that in real estate transactions, the term “cash” is used mainly for a situation where you have money in your account. Real cash - notes and coins - can only be paid up to a limit of 270,000 CZK and unfortunately you won’t find much on the market for that amount today. Therefore, the term "cash" in real estate really means broader situations such as:

- without the participation of third parties in financing

- Not needing a mortgage because you have enough of your own money

All this can be said in one word: Cash.

So if you are in a position where you have enough cash to buy a property, you don't need to worry about this stage and can move on.

If you need a mortgage or other loan for part of the money then it is necessary to resolve at this stage how much and in what way providers will be willing and able and to help you. For example, according to the rules of the Czech National Bank, you cannot currently obtain more than 80% of the value of real estate via a mortgage, and in addition, debts cannot exceed a certain ratio of income and debt. But there's more about that in the article: XXX. Whether the banks are able to provide you with a mortgage also depends on your immigration status in the Czech Republic. While this does not matter for the purchase of real estate, for the provision of credit this issue needs to be examined in depth. Our calculator here will give you a good idea of whether you can get a mortgage at all, how much you can borrow and under what conditions. We regularly update the data based on real conditions, so you get the most accurate "web-based" response possible regarding the possibility and amount of financing. Unlike generic calculators, which you will find everywhere, it not only gives you advertised offers with unrealistic "up to" and "from" parameters, but also strives to provide you with real offers applicable to your own specific situation (though, of course, no internet calculator will ever give you exactly the precise conditions - you must meet with a financial advisor and provide them with your own specific information) But our calculator will give you a sufficiently accurate answer to allow you to move on to the next stage of buying a property.

After getting information about how much money you can receive for the property, you still have to decide for yourself what budget you will actually assign to it i.e. whether you want to use all of your mortgage or own money and buy the most expensive property possible, or if you want to keep a certain amount in reserve, etc. And you need to stick to that decision in the next phase - finding a property.

This phase and its length is entirely down to you, so I have no set timeline to offer here. It's really just a matter of preparing a real estate budget.

Finding the right property

Nobody can tell you when exactly you will come across the right property, so I say again that it is perhaps better to do this only after the "before buying" phase. I have had clients in my office with whom we were looking for the right property for a year and a half! And here we should note that while this period gave us enough time to sort out the client's financing, after such a long period the banks’ mortgage offers were no longer the same. But at the start we didn't know that finding a property would take so long! It could have been the case, as with other clients, that we started looking and the second one we visited was perfect and we had actually made a decision within a week! In addition, some people have a very clear idea of what they want to buy, whereas for others it is just vague. And at this stage, it isn't a problem to change your requirements.

During my career in this field, I have found it has been better to take a wide perspective on things and base my expectations on real experiences of the market, rather than trying to use laser precision to find a specific property. Sadly the real estate market very often does not offer exactly what we are looking for, but can, however, also pleasantly surprise us with a type of property we hadn't previously considered. Arranging a tour costs nothing apart from your time and there is no shame in having 20 or 30 or more viewings of different properties before you work out what you really want. Similarly it's not necessarily wrong to buy the first property you visit. It's down to your gut feeling, whether it's the one for you or not! (If you follow the following steps and do not buy the property in a hurry. Being hasty doesn't depend on how many you visit, but what kind of inspection of the property you perform to establish whether you really want to buy it or not.). Again, one example for all to consider: one client was convinced from the outset that he wanted a three-room plus kitchen area apartment and nothing else. For almost a year, we walked around all the apartments of this size in his city. None was the right one. Eventually I found a four-room plus kitchen area house 10km outside the city. I actually had to get this client to this house under another pretext, so that I could prove that there were other options beyond three-room plus kitchen area flats around the center. He immediately fell in love with it, snapped it up and has been living in it happily for several years now. He readily admits in his own words he doesn't understand why wanted to live in an apartment when this option is better for him in all respects!

Therefore, only one thing for this phase, choose based on your own opinion. Do not reject anything on the basis that it probably isn’t absolutely perfect and you will not have a problem. Up till now in the process, you only have to worry about if you like the property and if you can afford it.

You will start to sort out more complicated problems only when you have chosen a property that you really like and want. In that case, do not conclude an agreement immediately on the spot of the type: "This is the one for me. I'll take it right away. Where should I send the money?" That would be the hastiness I mentioned earlier. Now, if you are sure that you want this property, you still need to ask yourself again if you really must buy it or if you will regret it. It is necessary to check in detail the material and legal condition of the property. These are very significant matters to consider and we will address them in more detail in the articles “Material Property Defects” and “Legal Property Defects”. Only if you find that everything is in order, or that the flaws are such that they will not change your opinion about buying the property, should you proceed to the next stage, which is:

Transfer of ownership/purchase of selected real estate

Here you become involved in the field of law, and deeply so. In my opinion, a good lawyer for this phase is a necessity, because it is possible to make mistakes, which in the worst case scenario, could cost you everything (yes, cases where the buyer paid for the property but did not acquire it have actually happened and may happen again!). Even if you do have a good lawyer on your side, you will still probably want to know what is going on around you. You should brace yourself for a lot of paperwork and contracts spinning around you at this stage, and you may get pretty dizzy from the whole legal carousel! Here I offer timelines of what this tricky process looks like, and how and when it is resolved when you buy a property with the help of a mortgage or with cash:

Figure. 1 - Cash

This is the timeline from the moment you sign the reservation contract (with the real estate agency) or some type of reservation agreement if you buy directly from the owner. In one line: "You do" is what is expected of you in the given phase and in the other line "We do" is what is expected from the other party (state agent, lawyer). Black lines are events that require the action of all parties (typically the signing of one of the contracts) and are followed by the time period in which the described thing happens. Above you can see how long the period lasts on average. For example, you may notice that after signing the reservation contracts, you wait for about three weeks during which you do nothing but read the draft contracts and perhaps comment on them. Similarly, after sending the money for safekeeping, you wait almost four weeks and do nothing at all - everything takes place at the cadastre. During these waiting periods, a lot of people can get nervous - after all, they have sent their lifetime savings to an account and now they can do nothing but wait. This timeline should help you understand that everything is completely fine and feel more at ease.

Figure 2

This picture is the same as the previous one, with only the addition of financing added to it, namely someone from a financial advisors office or bank. There are more contracts and papers to sign, but the procedure itself is still based on the fundamental one. On that front, nothing changes.

You may notice that several contracts are mentioned on the axis lines. You can learn more about their content, reason and more in the article, “Contracts made in the course of trade”.

After the transfer / purchase of real estate

If the property is transferred, you are the new owner according to the real estate cadastre, but there are still a few things to do.

- Transfer of real estate: The property still needs to be officially handed over to you after the transfer of ownership. The deadline for this is usually in the purchase contract and it is up to you and the owner what you agree in this case. In any case, you will need a handover protocol, where meter readings for water, electricity and gas in the property are recorded. This is important for the transcription of these utilities by suppliers. It also records the condition of the apartment, equipment and furnishings and whether everything is properly handed over as agreed at the outset. Only at this moment do you assume the risk of damage. In other words, if the property burns down before being handed over, it's the problem of the previous owner; if it burns down after handover, it's your problem. So if water leaked somewhere during the transfer of the property, mold appeared on the walls, etc, you must record this in the handover protocol and request a remedy from the previous owner!

- Rewriting of utilities into your name. There are several options for rewriting contracts of utilities suppliers over to you. It varies depending on whether you want to stay with the same company or change company, and the options available are constantly changing. This situation is always resolved at the time and so I cannot provide more detailed instructions here. However, what always applies is that the change of supplier is made on the date you take over the property and on condition that you record the meter readings in the handover protocol. But you only ask to change the name on the contract after this date. So there will be a period when the original owner will still be obliged to pay a deposit to suppliers, even though you will already be using the energy. However, the energy companies address this by billing them only on the basis of the dates you provide. They will return the overpayment from this period to the original owner, while they will charge you the difference after your contract with them takes effect. So, as I say, the process of rewriting utilities takes some time, but in the end you will be all set for the handover of the property.

- Taxes: Currently, as a buyer, you only need to concern yourself with one type of tax, and that is property tax. Tax registration for property tax is filed in January and the tax is paid as a lump sum for the whole year. Furthermore, the tax is always paid by the person who owned the property on 1 January of the given year. So if you buy a property in February, the tax for this year has already been paid and you will not need to deal with it until January the following year, when you must register and pay the tax. After that, you will automatically receive a receipt from the tax office every year.

Here you can still see the entire timeline - from start to finish.

Figure 3

And that's it! At this point you can say that you have successfully bought the property. And I can only repeat what I said at the beginning. For some it can be a very simple process; for others it is incredibly complicated. Some will want to sort out the whole thing themselves, some with a professional by their side, and everything in between. If you fall into the first category, I hope this and other articles will help you. If you fall into the other camps, please do not hesitate to contact us. We will do our best to find a form of cooperation beneficial for all. Some people may need specific advice for a specific step in the process, some may want to rely entirely on a lawyer recommended by us. We are open to all possibilities.